Check Your Credit Score for Free

Your Personal Information is 100% secured with us. We do not share your data with any third party.

Your credit score is like a report card for how well you've handled money in the past. It's a three-digit number that shows if you're good at paying back loans or using credit cards responsibly. Banks and other lenders use this score to decide if they can trust you to borrow money. The score goes up if you're good with money and down if you're not so good. So, it's like a grade that helps decide if you can get a loan when you need one.

Your Personal Information is 100% secured with us. We do not share your data with any third party.

Your credit score is like a trust rating for borrowing money. It tells lenders if you're good at paying back loans on time. When you want a loan or credit card, the lender checks your credit score to see if you're a safe bet. It helps them know if you're likely to repay what you borrow.

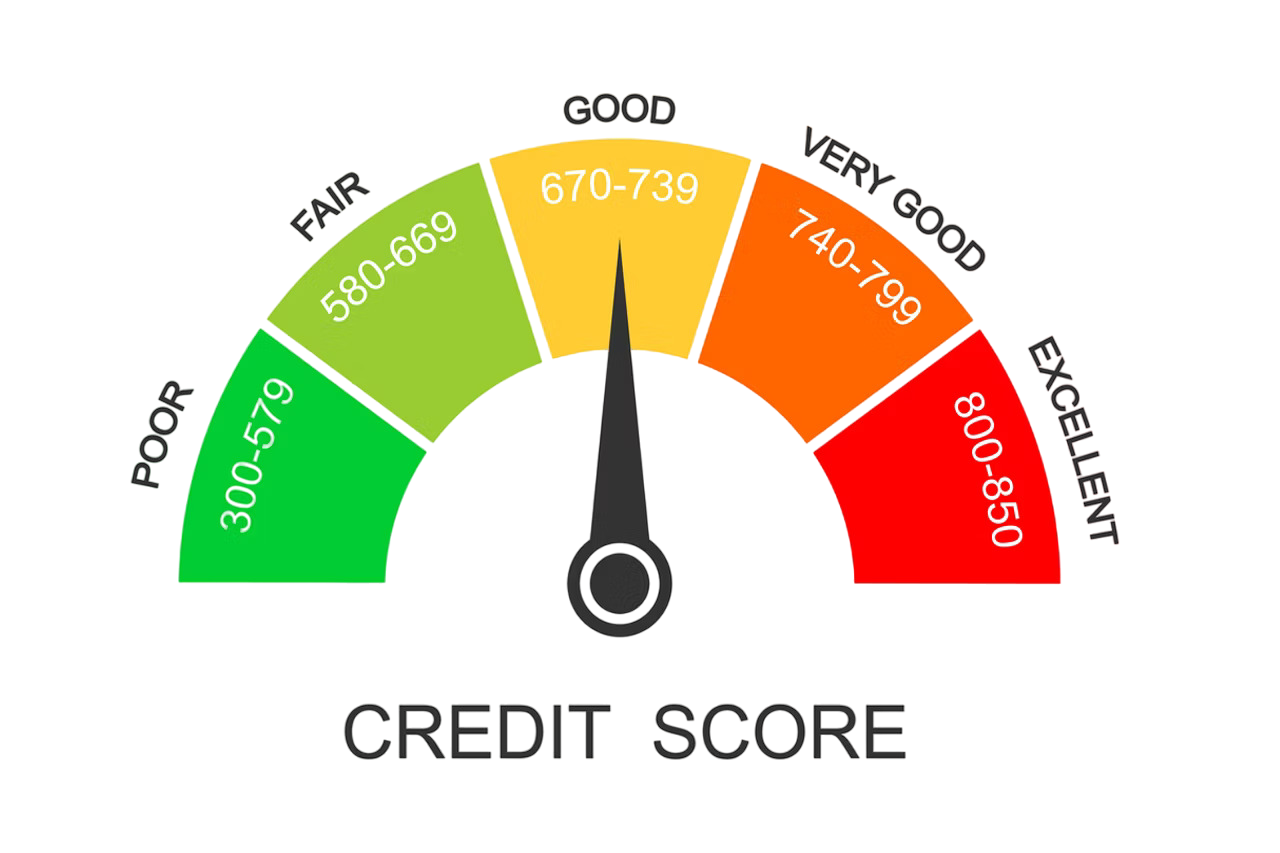

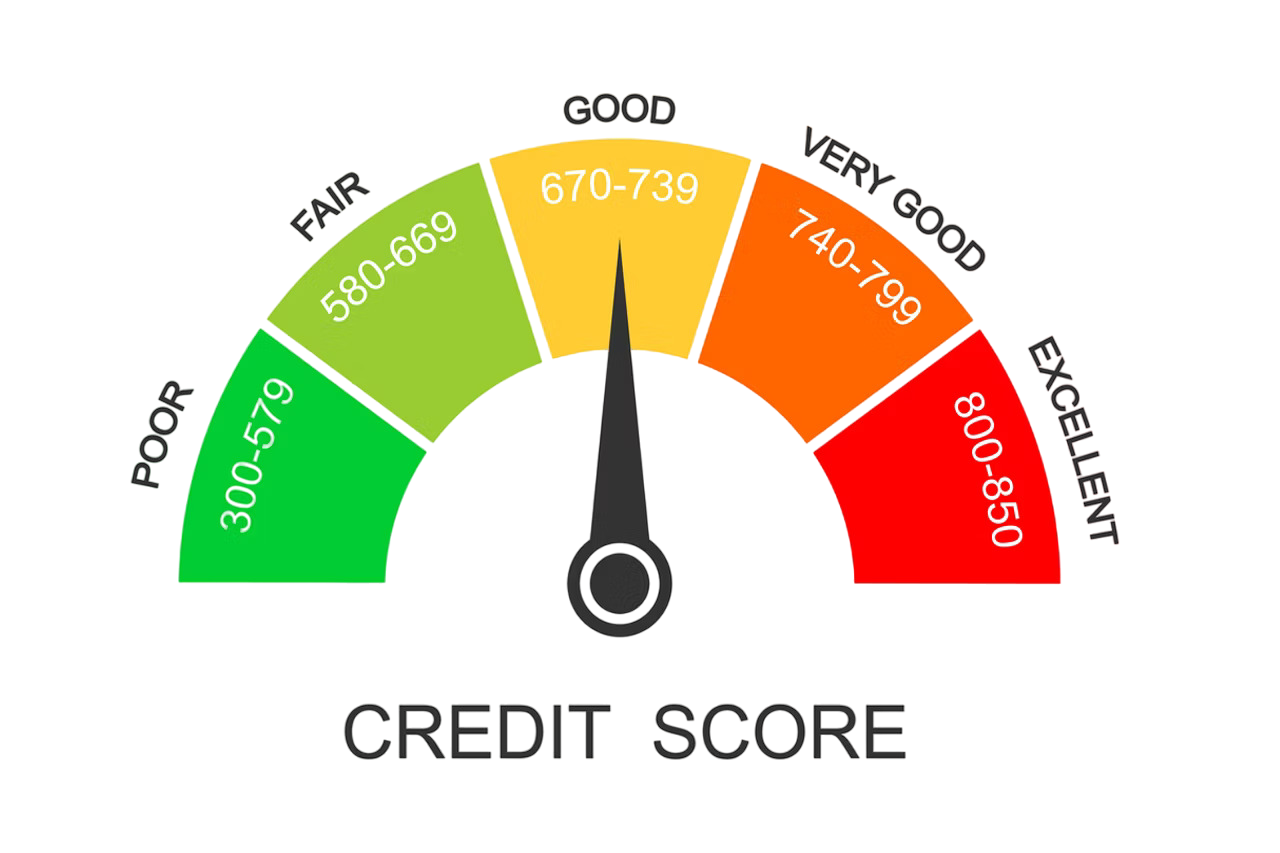

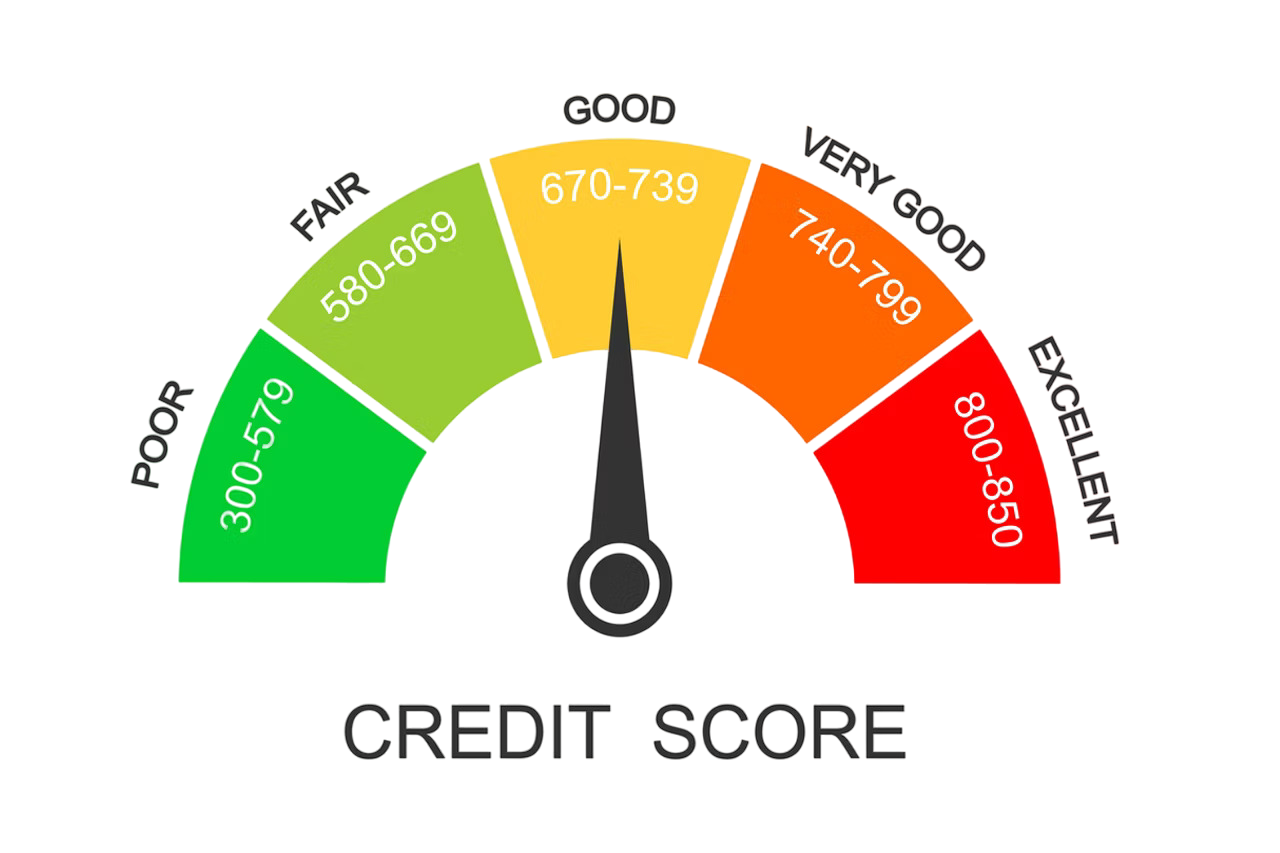

Think of your CIBIL score as a credit grade between 300 and 900. The higher the score, the better. If you have a score of 750 or more, that's like an A+ for lenders, and they really like that. They might still consider you for credit cards even if you have a score of 700 or higher. So, the higher your score, the more likely banks are to say "yes" when you ask for a loan or credit card.If you're late or miss paying your loan EMIs or credit card bills, it hurts your credit score. But if you're good about paying on time and don't apply for credit too often, your score goes up. So, paying your bills on time and not asking for credit too much helps boost your credit score.

TransUnion CIBIL (used to be called Credit Information Bureau (India) Limited) is like a report card keeper for your credit score. It's the oldest one in India, but there are three others: Experian, CRIF High Mark, and Equifax. These bureaus calculate your credit score based on info from banks and others. Because each bureau has its own way of calculating, your score might be a bit different with each. They all do the same job—keeping track of how well you handle credit.

You can easily check and download your credit report for free on MybankingTips.com. We team up with all four top credit bureaus, including CIBIL, so you can keep an eye on your credit score without spending a penny. It's quick and won't affect your score, whether you check it once or a bunch of times. So, in just a few minutes, you can stay on top of your credit game.

Your credit score is like a report card made by credit companies. They look at many things to figure it out, like how you've used credit before. And every time you ask for a new loan or credit card, these companies tell banks and others about how you've done with credit in the past.

Here are some important things that affect your credit score:

In addition to the main 5 factors, things like mistakes in your credit report, having a limited credit history, and not being able to fulfill your role as a loan guarantor can slightly lower your credit score.

A credit score of 750 and above from CIBIL or any credit bureau is generally considered good by most lenders. If you maintain a CIBIL score in this range, it's easier to get loan or credit card approvals, with higher chances if your score is closer to 900. However, it's possible to have a good CIBIL score while having a credit score below 700 from another bureau. Therefore, it's recommended to monitor your credit scores from multiple bureaus. Checking your credit score once a month is a good practice.

| Score Band | Category | Meaning |

|---|---|---|

| 300 | No Score/No History | It means you have never taken a loan or credit card and have no credit history. For the best offers on loans and credit cards in future, you should start building your credit score. |

| 300-550 | Very Low Credit Score | Your credit history is damaged. However, with awareness and discipline you can strengthen your credit score. Check your credit report thoroughly to find out why your credit score is low and take action. |

| 551-620 | Low Credit Score | You might not have shown a good credit behaviour that has damaged your credit history . You need to take immediate measures to improve your score to become eligible for credit in future. |

| 621-700 | Fair Credit Score | You are not very far from a strong credit score. To be eligible for the best offers, you should work on improving your score. |

| 701-749 | Good Credit Score | You have been responsible with credit and have displayed good credit behaviour. Most banks and NBFCs would be happy to offer you credit. |

| 750+ | Excellent Credit Score | Your track-record with credit is superb! With this score, you would meet the eligibility criteria of most banks and NBFCs and are likely to get the best offers. |

Please Note: The credit score range mentioned above is only indicative and may vary from lender to lender and bureau to bureau.

When you apply for a loan or credit card, the bank or NBFC usually checks your credit score first. If your score is low, they might say no right away and not look at your application in more detail.

A high credit score is like a green light for lenders. It means they'll dig deeper into your application to see if you're trustworthy with credit. So, a good credit score boosts the chances of getting your loan approved.

While a good credit score is important, it's not the only thing lenders check when deciding to give you credit. They also look at your income, how you've repaid loans before, your debt compared to your income, your work history, job, and more. All these details help them decide whether to approve or deny your loan or credit card application.

Having a good credit score not only helps you get credit but can also save you money. Some banks and companies give people with good credit scores a special deal on interest rates for loans. So, a good score can mean paying less interest when you borrow money.

While lenders look at various factors for loan or credit card applications, your credit score is crucial. Keeping a good credit score offers several advantages, such as:

If your credit score is low, it can be tough to get approved for loans or credit cards. To boost your credit score, follow these steps carefully:

Improve your credit score by following these steps:

You can easily check your credit score for free every month on mybankingtips.com, a reliable platform for online credit score checks from different credit bureaus.

Additionally, following RBI's guidelines, credit bureaus are required to provide a Full Free Credit Report (FFCR) once a year to individuals with the credit information they possess. You can request your free credit report once a year from CIBIL's official website.

When you check your credit score on MybankingTips, you receive scores from various bureaus. Your CIBIL report is available on the dashboard alongside your CIBIL score. You can download your CIBIL report from there, and the password for accessing it is set as DDMMYYYY.

The minimum CIBIL score needed for approval of unsecured loans like personal or business loans varies among lenders. Yet, having a CIBIL score of 750 and above makes it easier to get your loan approved. While some lenders may consider applications with a score of 700, it might come with higher interest rates.

No. Your CIBIL score is private and confidential. Only you or authorized entities with your consent are allowed to access it. Typically, financial institutions and banks, which are trusted CIBIL members, can access your credit report when you apply for a new loan or credit card.

Keeping a credit score of 750 and above is seen as good because it reflects financial discipline and makes you a reliable customer for lenders. A solid CIBIL Score in this range increases your likelihood of approval for credit products such as loans and credit cards.

Your CIBIL score can be affected by various factors, both subtle and noticeable. Small details like late payments or reaching your credit card limit can impact it. Additionally, significant events such as taking out a new home or car loan can also influence your credit score.