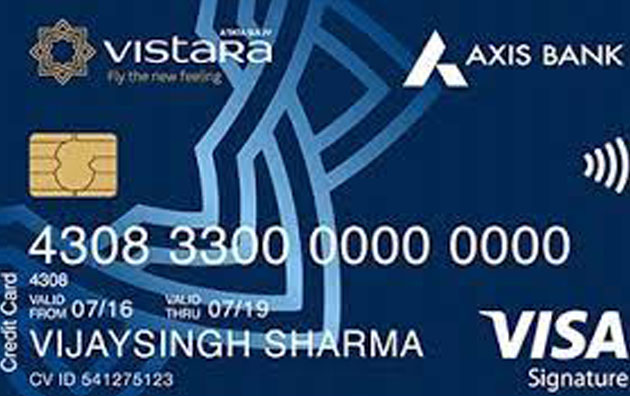

Axis Vistara Signature Credit Card

Dining

Dining

Best Suited For: Travel

Joining Fee: ₹3,000* Plus Applicable Taxes

Renewal Fee: ₹3,000* Plus Applicable Taxes

Dining

Dining

Best Suited For: Travel

Joining Fee: ₹3,000* Plus Applicable Taxes

Renewal Fee: ₹3,000* Plus Applicable Taxes

Welcome Benefit

Welcome Benefit

Complimentary Premium Economy Ticket

Dining

Dining

Receive a 25% discount, up to Rs. 800, through the Eazy Diner membership.

Lounge Access

Lounge Access

Enjoy complimentary access to designated airport lounges within India.

Best Features:- Get up to 4 complimentary Premium Economy tickets in a year as milestone benefit

Check your eligibility for this card

.png) Top Credit Cards in India

Top Credit Cards in India